What is Accounts Payable? A Complete Guide for 2025

Learn everything about accounts payable: definition, process, best practices, and how automation is transforming AP operations for businesses in 2025.

What is Accounts Payable? A Complete Guide for 2025

If you're new to business finance or looking to deepen your understanding of accounting fundamentals, you've likely encountered the term "accounts payable." But what exactly does accounts payable mean, and why is it so crucial to your business operations?

In this comprehensive guide, we'll break down everything you need to know about accounts payable (AP), from basic definitions to modern best practices that can transform how your business manages vendor payments and cash flow in 2025.

What is Accounts Payable? The Definition

Accounts payable (AP) is the money your business owes to suppliers, vendors, or creditors for goods or services received on credit but not yet paid for. In accounting terms, accounts payable represents a short-term liability on your company's balance sheet—essentially an IOU that you'll need to settle within a specific timeframe, typically 30, 60, or 90 days.

According to Coursera's financial definition, accounts payable is "an accounting term that describes the short-term debt that a company owes to its suppliers or vendors for products or services received before a payment is made."

The term "accounts payable" can actually refer to three different things:

- An account on your general ledger - The specific liability account where unpaid vendor invoices are recorded

- A department within your company - The team responsible for processing invoices and managing vendor payments

- A financial obligation - The actual money you owe to creditors at any given time

All three definitions revolve around the same core concept: tracking and managing what your business owes to others.

How Does Accounts Payable Work?

Understanding how accounts payable works is essential for maintaining healthy cash flow and strong vendor relationships. Here's a simplified example:

Imagine you run a manufacturing company that orders $10,000 worth of raw materials from a supplier. The supplier ships the materials with an invoice that offers net 30-day payment terms. Your company receives the goods and invoice but doesn't pay immediately.

At this point:

- Your accounts payable increases by $10,000 (you owe money)

- Your assets increase by $10,000 (you have inventory)

- This appears as a liability on your balance sheet

When you pay the invoice 30 days later:

- Your accounts payable decreases by $10,000 (debt is cleared)

- Your cash decreases by $10,000 (money leaves your bank account)

This delayed payment structure is fundamental to business operations. It allows companies to receive goods and services immediately while preserving cash flow by paying later. According to Sage Advice, this credit arrangement is crucial for maintaining business liquidity and operational efficiency.

Accounts Payable vs. Accounts Receivable: What's the Difference?

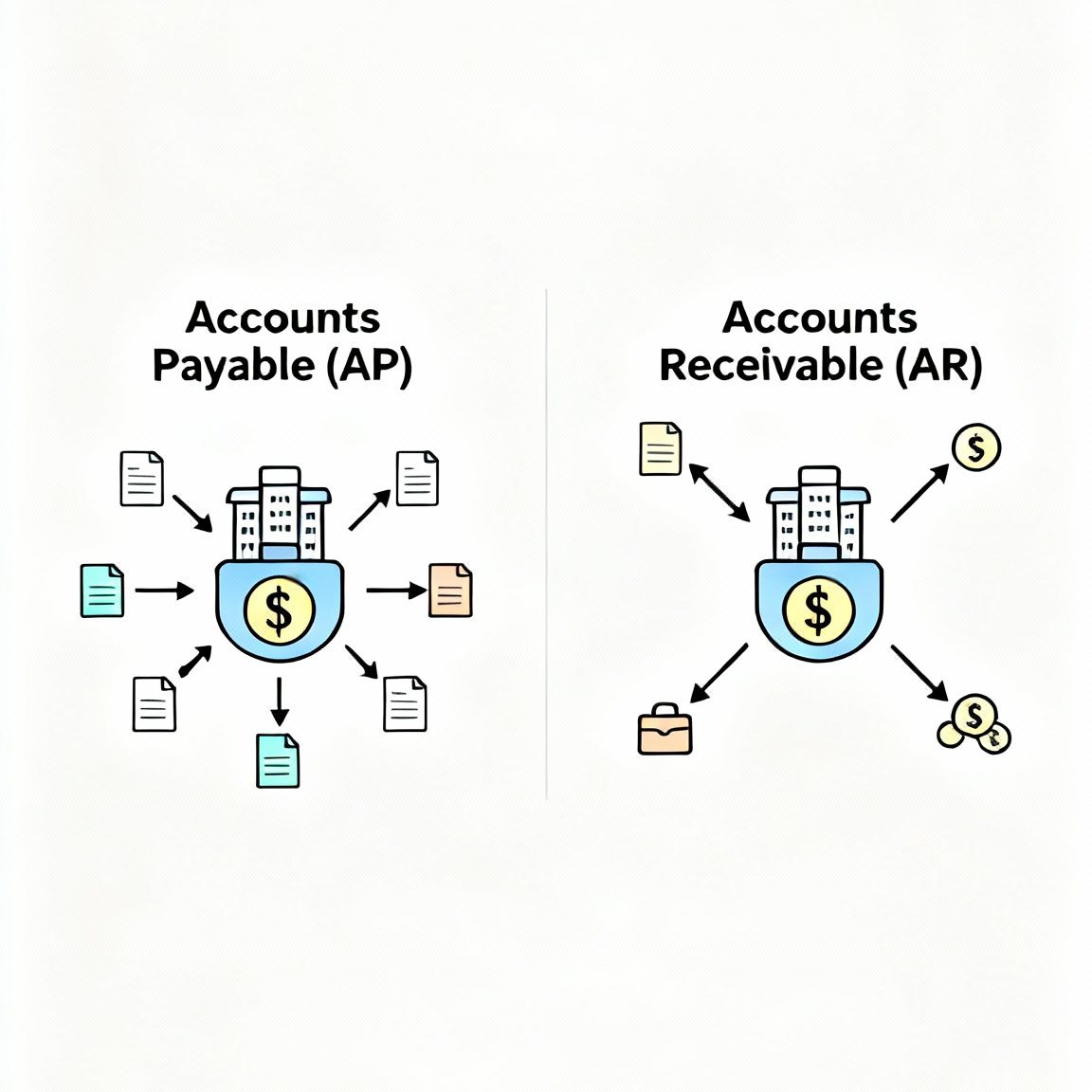

Many people confuse accounts payable with accounts receivable (AR), but they're actually opposite sides of the same coin.

Accounts Payable (AP):

- Money your business owes to others

- Appears as a liability on the balance sheet

- Represents outgoing cash flow

- Example: Invoices from suppliers you haven't paid yet

Accounts Receivable (AR):

- Money others owe to your business

- Appears as an asset on the balance sheet

- Represents incoming cash flow

- Example: Invoices you've sent to customers who haven't paid yet

As NetSuite explains, "Accounts payable represents the amounts a company owes to its suppliers or creditors, whereas accounts receivable represents the amounts owed to the company by its customers or clients."

Both AP and AR are critical for cash flow management. Effective businesses optimize both sides: collecting receivables quickly while strategically timing payables to maximize working capital.

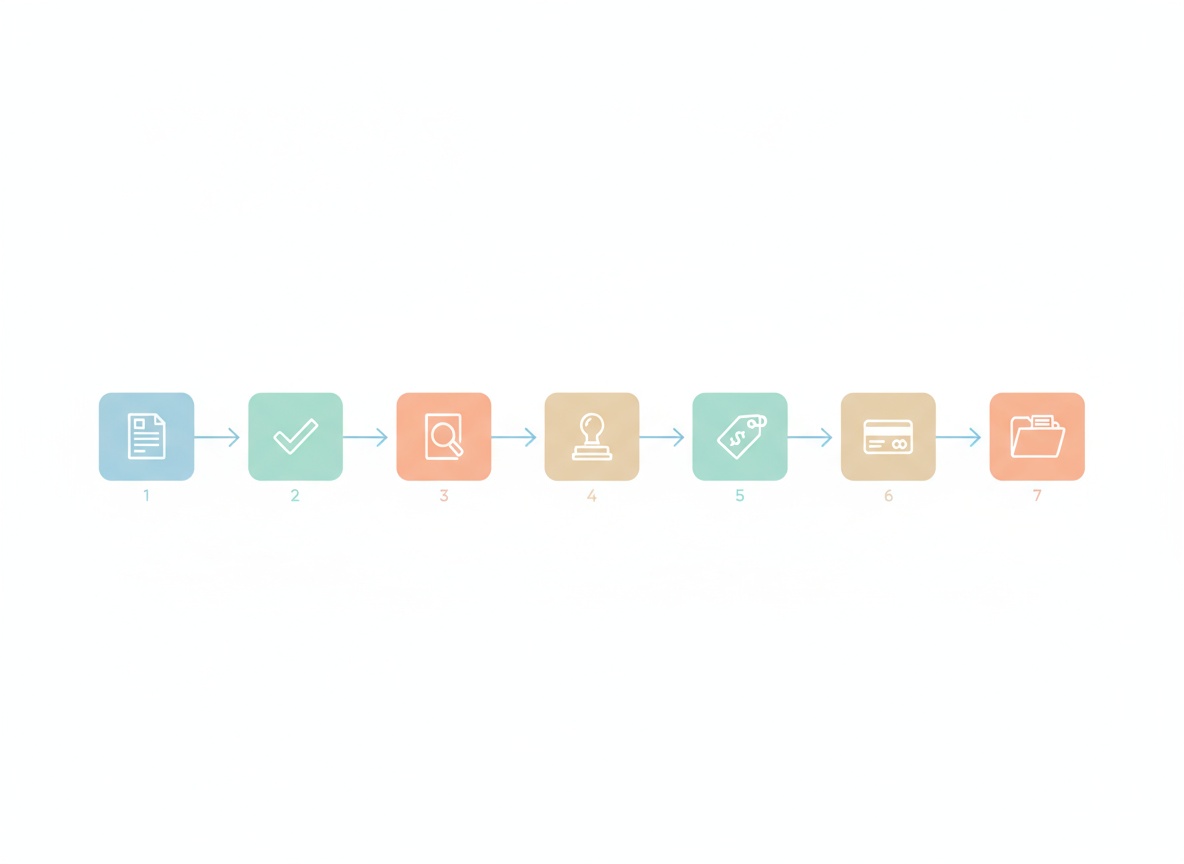

The Accounts Payable Process: Step-by-Step

The accounts payable process involves several key steps to ensure invoices are accurate, authorized, and paid on time. Here's the typical AP workflow that businesses follow:

For a comprehensive video walkthrough of the accounts payable process, AP expert Mary Schaeffer breaks down all the moving parts that accounting professionals need to understand:

1. Invoice Receipt

The process begins when your business receives an invoice from a supplier for goods or services delivered. Invoices can arrive via email, postal mail, electronic data interchange (EDI), or supplier portals.

2. Invoice Verification

AP staff review the invoice to ensure it contains all necessary information:

- Vendor name and contact details

- Invoice number and date

- Description of goods/services

- Quantities and unit prices

- Total amount due

- Payment terms and due date

3. Three-Way Matching

This critical step involves matching three documents to verify the transaction:

- Purchase Order (PO) - What you agreed to buy

- Invoice - What the vendor is billing you for

- Receiving Report - What you actually received

According to Tipalti's best practices guide, three-way matching helps "block price/quantity errors and overpayments before posting" and is essential for fraud prevention.

4. Approval Workflow

Once verified, invoices route to appropriate approvers based on:

- Amount thresholds

- Department budgets

- Vendor type

- GL coding

5. Invoice Coding

AP staff assign the correct general ledger (GL) codes, cost centers, and project codes to ensure accurate financial reporting and expense tracking.

6. Payment Processing

After approval, invoices are scheduled for payment according to due dates and cash flow considerations. Payment methods include:

- ACH transfers (most cost-effective)

- Wire transfers (for urgent payments)

- Checks (increasingly rare)

- Virtual cards (for added security and rebates)

7. Record Keeping

All documents are filed and retained according to accounting standards and regulatory requirements, typically for 7+ years.

Essential Accounts Payable Terms You Should Know

Familiarizing yourself with common AP terminology will help you navigate conversations with accountants, vendors, and financial software:

- Net Terms - Payment due within a specified number of days (e.g., Net 30 means payment due in 30 days)

- 2/10 Net 30 - 2% discount if paid within 10 days, otherwise full amount due in 30 days

- Trade Credit - The credit extended by suppliers allowing you to pay later

- Invoice Date - When the supplier issued the invoice

- Due Date - When payment must be received to avoid late fees

- GL Code - General ledger account number for categorizing expenses

- PO Number - Purchase order reference linking invoice to authorization

- Days Payable Outstanding (DPO) - Average number of days your company takes to pay invoices

- Accrued Expenses - Expenses incurred but not yet invoiced

- Vendor Master File - Database containing all approved vendor information

Best Practices for Managing Accounts Payable in 2025

Effective accounts payable management goes beyond simply paying bills on time. Modern AP best practices include:

1. Implement Separation of Duties

No single person should control the entire payment process from invoice receipt through payment approval. This internal control reduces fraud risk and improves accuracy. As noted by UC Davis Finance Guidelines, separation of duties is fundamental to sound financial controls.

2. Digitize and Automate

Manual, paper-based AP processes are error-prone and inefficient. Digital transformation in AP enables:

- Faster invoice processing

- Better visibility into cash flow

- Reduced data entry errors

- Real-time reporting capabilities

For operations-heavy businesses in logistics, manufacturing, and trade, automation becomes even more critical when managing hundreds or thousands of supplier invoices monthly.

3. Standardize Your Process

Create documented procedures for:

- Invoice submission requirements

- Approval hierarchies

- Payment schedules

- Exception handling

- Vendor onboarding

Standardization ensures consistency, reduces confusion, and makes training new staff easier.

4. Leverage Early Payment Discounts

Many suppliers offer discounts for early payment (like 2/10 Net 30). According to Stampli's AP management strategies, capturing these discounts can generate significant annual savings—often equivalent to 18-36% annual return on invested cash.

5. Optimize Payment Timing

While capturing discounts is valuable, don't pay bills too early. Strategic payment timing maximizes working capital by:

- Keeping cash in your accounts longer

- Earning interest on available funds

- Maintaining financial flexibility

The key is paying on time (avoiding late fees) without paying unnecessarily early.

6. Maintain Strong Vendor Relationships

Your AP department is often the primary point of contact with suppliers. Professional, timely communication and reliable payments build trust that can lead to:

- Better pricing negotiations

- Priority service during shortages

- More favorable payment terms

- Collaborative problem-solving

7. Regularly Reconcile Accounts

Monthly reconciliation of your AP subsidiary ledger to the general ledger ensures accuracy and catches errors early. This practice also prepares you for audits and provides accurate financial reporting.

8. Monitor Key Performance Indicators (KPIs)

Track metrics like:

- Cost per invoice processed

- Invoice processing time

- Number of exceptions/errors

- Percentage of invoices paid on time

- Days payable outstanding (DPO)

- Capture rate of early payment discounts

These KPIs help identify bottlenecks and measure improvement over time.

Why Accounts Payable Matters for Your Business

Effective accounts payable management impacts your business far beyond simply paying bills. Here's why AP deserves strategic attention:

Cash Flow Optimization

Your AP balance directly affects cash flow. Managing payment timing strategically ensures you have funds available for growth investments, unexpected expenses, and operational needs while maintaining good vendor relationships.

Vendor Relationships

Consistent, on-time payments build supplier trust and goodwill. This translates into better service, priority access to inventory during shortages, more flexible terms, and willingness to work with you during challenging times.

Financial Accuracy

Proper AP processes ensure your financial statements accurately reflect your liabilities, expenses, and cash position. This accuracy is crucial for:

- Making informed business decisions

- Securing financing from banks

- Meeting audit requirements

- Tax compliance

Fraud Prevention

According to Association of Certified Fraud Examiners data, businesses lose an average of 5% of revenue to fraud annually. Strong AP controls including separation of duties, three-way matching, and approval workflows significantly reduce this risk.

Working Capital Management

Effective AP management frees up working capital by:

- Extending payment cycles within terms

- Capturing early payment discounts when ROI justifies it

- Avoiding late payment penalties

- Optimizing days payable outstanding (DPO)

Compliance and Audit Readiness

Proper documentation, approval trails, and record retention ensure you're prepared for:

- Tax audits

- Financial audits

- Regulatory compliance (SOX, GDPR, etc.)

- Vendor disputes

Common Accounts Payable Challenges

Despite its importance, many businesses struggle with AP management. Common challenges include:

Manual, Paper-Based Processes

According to industry research, manually processing invoices costs $12-17 per invoice and takes 9-11 days on average. Manual processes also introduce data entry errors, lost invoices, and limited visibility.

Invoice Exceptions and Discrepancies

Invoices that don't match purchase orders, incorrect pricing, quantity disputes, and missing information create bottlenecks requiring manual intervention and delaying payment.

Approval Bottlenecks

Invoices often sit in approval queues when approvers are traveling, on vacation, or simply overwhelmed. This delays payment and can damage vendor relationships or result in late fees.

Duplicate Payments

Without proper controls, businesses sometimes pay the same invoice twice—especially when receiving multiple copies via different channels (email, mail, portal). These errors are difficult to recover and hurt the bottom line.

Lack of Visibility

Traditional AP processes offer limited real-time visibility into:

- Outstanding liabilities

- Upcoming payment obligations

- Cash flow projections

- AP performance metrics

This lack of insight makes strategic financial planning difficult.

Fraud Vulnerability

Manual processes and weak controls create opportunities for fraud including:

- Fictitious vendor schemes

- Invoice manipulation

- Payment diversion

- Kickback arrangements

Limited Resources

Many AP departments are understaffed and overwhelmed, especially during peak periods like month-end closing. This leads to:

- Processing delays

- Increased errors

- Missed discount opportunities

- Employee burnout

Modern Solutions: How Automation is Transforming Accounts Payable

The good news? Technology is revolutionizing accounts payable, addressing many traditional challenges while delivering significant benefits.

AI-Powered Invoice Processing

Modern AP automation platforms use artificial intelligence and optical character recognition (OCR) to:

- Extract data from invoices automatically (regardless of format)

- Match invoices to purchase orders instantly

- Route invoices for approval based on rules

- Flag exceptions for human review

- Code invoices to GL accounts using machine learning

This technology reduces processing costs to under $5 per invoice while cutting processing time to 1-2 days, according to industry benchmarks.

Three-Way Matching Automation

Automated three-way matching compares purchase orders, receiving reports, and invoices in seconds—catching discrepancies immediately and blocking payment until resolved. This eliminates manual reconciliation while improving accuracy.

Electronic Payment Integration

Modern AP systems integrate with payment platforms to enable:

- Scheduled ACH payments

- Same-day payments when urgent

- Virtual card payments (generating rebates)

- International wire transfers

- Real-time payment status tracking

Real-Time Visibility and Reporting

Cloud-based AP systems provide dashboards showing:

- Current AP balance and aging

- Upcoming payment obligations

- Cash flow projections

- Process metrics and KPIs

- Vendor payment history

This visibility enables better financial decision-making and strategic planning.

Fraud Detection

AI-powered systems identify potential fraud by:

- Detecting duplicate invoices

- Flagging unusual amounts or patterns

- Verifying vendor banking information changes

- Analyzing historical patterns

- Cross-referencing vendor master data

Scalability for Growth

For operations-heavy businesses processing hundreds or thousands of invoices monthly, automation provides the scalability to grow without proportionally increasing AP headcount.

Fynra's AI-powered platform is specifically designed to automate invoice extraction, three-way matching, and payment workflows for logistics, manufacturing, and trade businesses—eliminating manual reconciliation across email and spreadsheets while delivering 80% cost savings.

Getting Started with Better Accounts Payable Management

Whether you're just learning about accounts payable or looking to improve your existing processes, here are actionable next steps:

For Small Businesses Just Starting Out:

- Set up a dedicated email for receiving invoices

- Create a simple tracking spreadsheet with vendor name, invoice number, amount, due date, and payment status

- Establish a weekly invoice review and payment schedule

- Open vendor accounts with clear payment terms

- Keep all invoices and payment records organized for tax purposes

For Growing Businesses:

- Audit your current AP process to identify bottlenecks

- Implement three-way matching even if manual initially

- Establish formal approval workflows

- Track key metrics like cost per invoice and processing time

- Evaluate AP automation software options

- Consider outsourcing if volume exceeds in-house capacity

For Established Businesses Ready to Optimize:

- Calculate your current AP processing costs and time

- Identify automation opportunities with highest ROI

- Research AP automation platforms suited to your industry

- Pilot automation with a subset of invoices

- Train staff on new systems and processes

- Monitor results and iterate based on data

Conclusion: Accounts Payable is More Strategic Than You Think

Accounts payable might seem like a back-office function focused on paying bills, but it's actually a strategic component of financial management that impacts cash flow, vendor relationships, fraud risk, and operational efficiency.

Understanding what accounts payable is—from the basic definition to modern best practices—empowers you to optimize this crucial function. Whether you're a business owner, finance professional, or operations manager, investing attention in AP management pays dividends through:

- Improved cash flow and working capital

- Stronger vendor relationships

- Reduced costs and errors

- Better financial visibility

- Fraud protection

- Scalability for growth

As we move through 2025, businesses that embrace AP automation and best practices will gain significant competitive advantages over those still relying on manual, paper-based processes.

Ready to transform your accounts payable operations? Learn how Fynra automates AP for operations-heavy businesses or explore more insights on our blog.

Frequently Asked Questions About Accounts Payable

Is accounts payable an asset or liability?

Accounts payable is a liability. It represents money your business owes to others, which appears under current liabilities on the balance sheet.

What's the difference between accounts payable and expenses?

Expenses are costs incurred by your business (recorded when goods/services are received). Accounts payable is the liability created when those expenses haven't been paid yet. Once you pay the invoice, AP decreases and cash decreases, but the expense was already recorded.

How long should accounts payable be outstanding?

This depends on payment terms agreed with vendors. Common terms are Net 30, Net 60, or Net 90 days. The key is paying within terms to maintain good relationships while optimizing your cash flow.

What happens if I pay accounts payable late?

Late payments can result in late fees, damaged vendor relationships, potential suspension of credit terms, and in extreme cases, legal action. Chronic late payment can harm your business reputation and creditworthiness.

Can accounts payable be negative?

Yes, occasionally. A negative AP balance usually indicates you've overpaid a vendor or received a credit that exceeds current amounts owed. This should be investigated and reconciled.

Related Resources:

- How AI is Transforming Accounts Payable: A Complete Guide for 2025

- Join Fynra's Waitlist for AP Automation

- Explore More Accounts Payable Insights

Sources and Further Reading: